The EasyUmbrella Fund Advantage

Umbrella funds offer significant advantages for small companies that can't manage their own employee retirement benefits.

Why choose the EasyUmbrella Fund:

Offer competitive retirement benefits with zero administrative costs and no hidden fees, maximizing growth for your employees. Enjoy seamless fund management, comprehensive risk coverage, and 24/7 access via an intuitive online portal. Attract and retain top talent with our cost-effective, efficient solution.

About

The Easy Umbrella Fund is designed to democratize savings and investment opportunities, making it accessible for everyone, regardless of their financial background. By pooling the assets of multiple smaller funds, our platform offers significant benefits, including cost efficiency, no minimum investment requirements, and no hidden fees. Our innovative approach allows small companies to offer competitive retirement benefits to their employees, helping them attract and retain qualified talent.

With our tech-driven platform, employees have 24/7 access to their fund details via an online portal or WhatsApp, providing transparency and ease of use. We partner with top insurance companies to offer comprehensive risk benefits and a diverse range of investment options, including stocks on the JSE and NYSE. Our dedicated support team ensures a seamless and efficient investment experience, handling everything from onboarding to claims management with a 48-hour turnaround time. Join us and take advantage of a valuable retirement solution tailored to meet the needs of modern employees and employers alike.

Governance and Administration

Board of Trustees

The EUF is overseen by a Board of Trustees comprising four trustees (two of whom are independent) and an independent Principal Officer. This board ensures the fund operates within legislative frameworks and in the best interests of both employers and members.

Management Committee

Each participating employer forms a management committee to facilitate communication, expedite claims, and monitor investment performance. Members can elect 50% of the committee representation, ensuring their voices are heard.

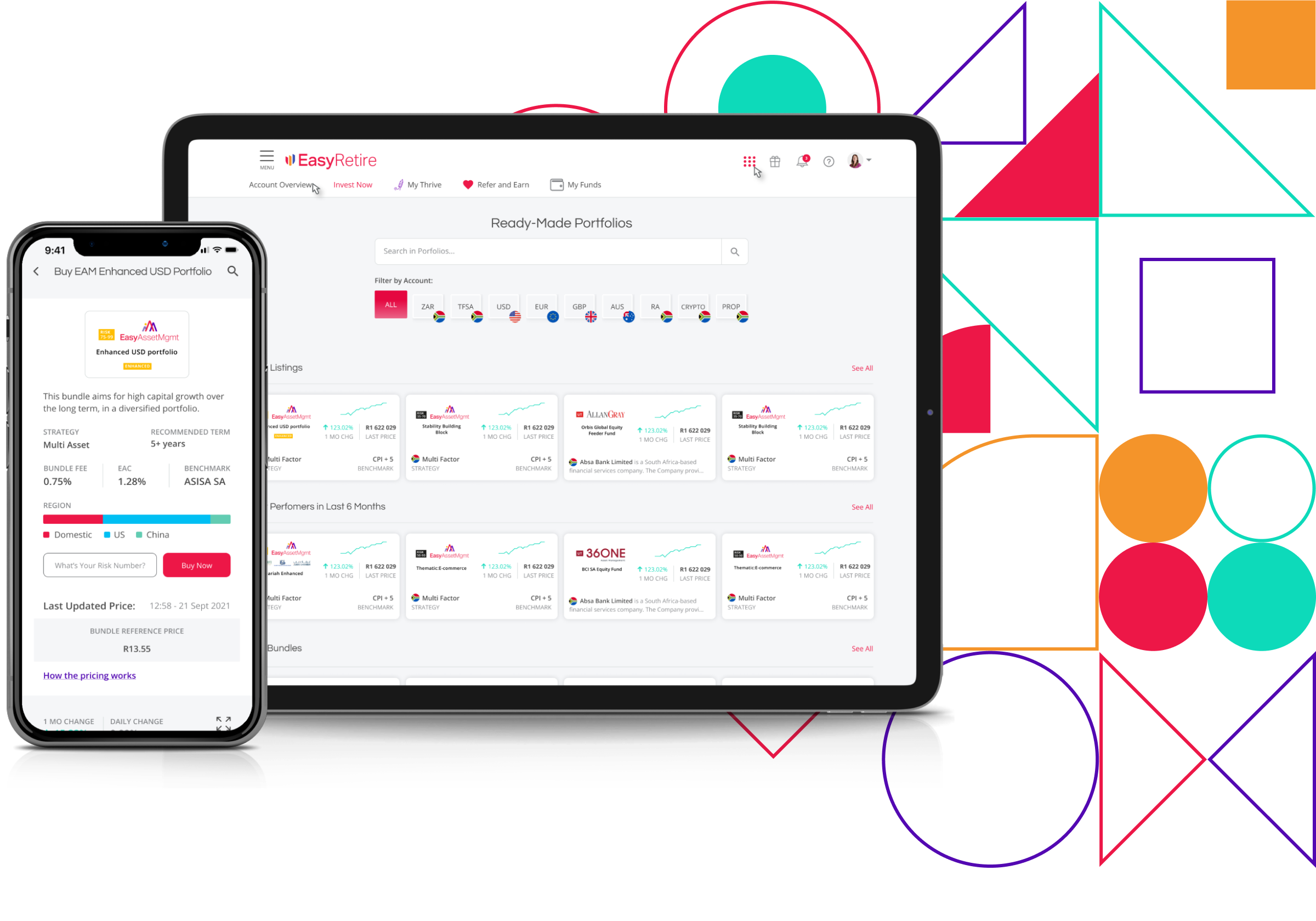

Innovative Investment Platform

Our platform revolutionizes retirement savings by offering a seamless, user-friendly experience that maximizes growth and security for your employees’ financial futures. With advanced technology and strategic partnerships, we provide a comprehensive suite of investment options and tools to ensure your employees can invest with confidence and ease.

More Than Just Retirement

More Than Just Retirement

EUF goes beyond traditional retirement benefits. It fosters a culture of financial well-being by:

Breaking Down Barriers

EUF eliminates minimum investment requirements, making saving accessible to everyone in your company.

Building a Brighter Future

EUF empowers employees to take control of their financial independence by allowing long, medium and short term investment options fostering a more secure and engaged workforce.

Streamlined Fund Administration

Streamlined Fund Administration

Administered by RISE, our platform automates the onboarding process, data management, and claims processing. Key benefits include:

- Efficient claims management with a 48-hour turnaround time.

- Online access to all fund details.

- Seamless contribution and investment tracking.

Communication and Education

Communication and Education

We prioritise clear and efficient communication with both employers and employees. Our WhatsApp portal and online platform provide:

Membership certificates | Annual and monthly benefit statements | Trustee annual reports | Real-time investment updates | Q&A -covers a multitude of relevant retirement topics

Diverse Investment Options

Diverse Investment Options

Our wide range of investment portfolios meets various risk and return requirements. Managed by experienced fund managers, our options include:

- RISE Money Market Fund: Low-risk, short-term capital protection.

- RISE CPI +3% Fund: Low-risk, global balanced portfolio.

- RISE CPI +5% Fund: Medium-risk, global balanced portfolio.

- RISE CPI +7% Fund: Aggressive, global balanced portfolio.

- RISE Shariah Balanced Fund: Medium-risk, Shariah-compliant.

Additionally, we offer external fund options like Allan Gray and Coronation funds, providing further diversification and risk management, at an additional platform fee

Join the Future of Retirement Planning

At EasyRetire, we are unwavering in our commitment to securing brighter financial futures for individuals as they embark on their retirement journey. Our core mission centers on optimizing retirement outcomes through strategic investment management, meticulous fund administration, and a dedication to ethical investment management.

We understand that retirement planning is not just about numbers; it's about the lives and dreams of individuals who have worked diligently throughout their careers. Our holistic approach to retirement fund management ensures that every member's unique financial goals and aspirations are given the utmost consideration.

With EasyRetire, you can rest assured that your retirement nest egg is in capable hands. We strive to achieve consistent, long-term growth and provide peace of mind to our members, enabling them to enjoy their retirement years to the fullest.

EasyUmbrella Fund: Key Information

Registered Name: EasyUmbrella Fund (EUF)

Umbrella Sponsor: EasyEquities

Provident Fund Registration Number: 12/8/38201

Funding Model: Defined Contribution

Fund Administrator: RISE, Registration Number 2010/022492/07

Registered Address: WeWork - Coworking Office Space, 173 Oxford Rd, Rosebank, Johannesburg, 2196

Governance and Administration

Board of Trustees

The EUF is overseen by a Board of Trustees comprising four trustees (two of whom are independent) and an independent Principal Officer. This board ensures the fund operates within legislative frameworks and in the best interests of both employers and members.

Management Committee

Each participating employer forms a management committee to facilitate communication, expedite claims, and monitor investment performance. Members can elect 50% of the committee representation, ensuring their voices are heard.

Join the Future of Retirement Planning

Our suite of products and services is designed to simplify the journey, ensuring that your financial future is in capable hands.

Contact Us